Why Is Wayfair So Cheap Right Now?

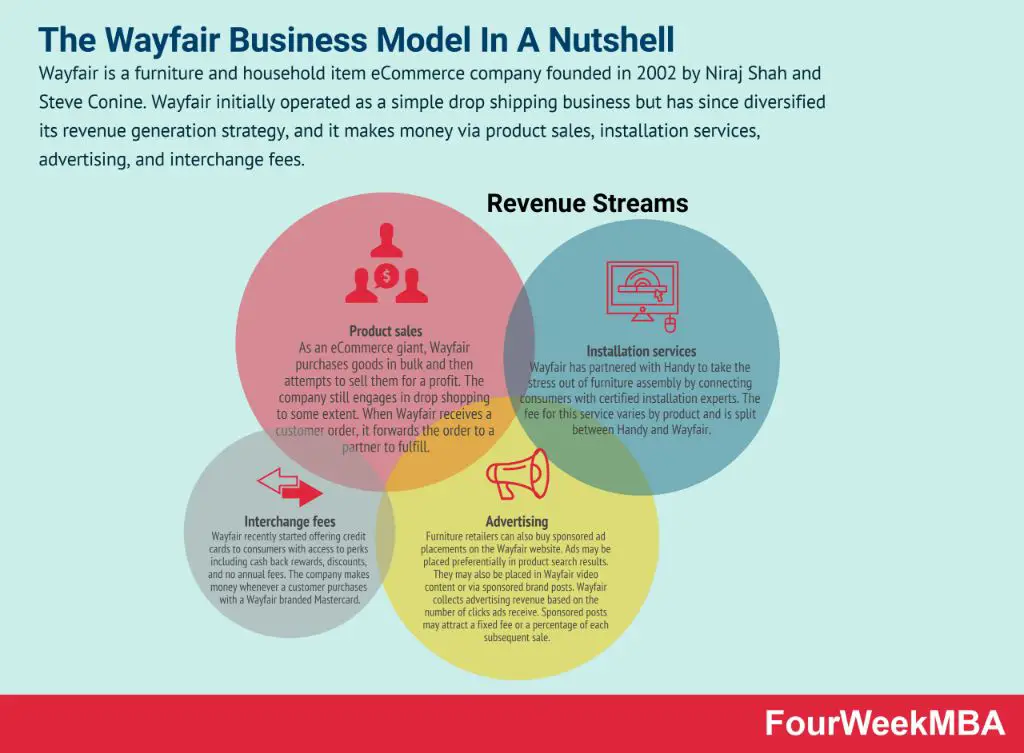

Wayfair is an online home goods retailer that sells furniture, home decor, kitchenware, and more. Founded in 2002, Wayfair operates mainly on a drop-shipping model, where it does not keep inventory but instead partners with suppliers to ship products directly to customers (https://businessmodelanalyst.com/wayfair-business-model/). This allows Wayfair to offer an extensive catalog of over 14 million products without the overhead costs of warehousing and maintaining inventory.

Wayfair is known for having relatively low prices compared to other retailers. The company is able to keep costs low due to its technology-driven, data-based pricing strategies and highly efficient supply chain and logistics network (https://thinkinsights.net/digital/wayfair-business-model/). Recently, Wayfair has been running even deeper discounts and sales, driving many shoppers to wonder – why are Wayfair’s prices so cheap right now?

Wayfair’s Inventory and Supply Chain

Wayfair sources the majority of its products directly from over 16,000 suppliers and manufacturers around the world, rather than holding inventory in warehouses. This just-in-time inventory model allows Wayfair to offer lower prices in a number of ways.

By working directly with suppliers, Wayfair avoids costly distribution and wholesale markups that can increase prices. Their proprietary logistics platform, CastleGate, allows suppliers to ship orders directly to customers with ease. This eliminates the need for Wayfair to store inventory while waiting for orders, reducing overhead costs like warehousing and labor.

As explained by Wayfair’s CEO, “The majority of the inventory in our supply chain is owned by our supplier partners” (Chain Store Age). With their direct supplier relationships and CastleGate fulfillment, Wayfair relies less on holding excess inventory, which allows them to offer competitive pricing.

Minimal Overhead and Operating Costs

One of the biggest reasons Wayfair is able to offer such low prices is their minimal overhead and operating costs compared to traditional retailers. Wayfair operates entirely online through its website and mobile apps, with no brick-and-mortar showrooms or retail stores. This allows Wayfair to avoid the high fixed costs associated with operating physical retail spaces, like rent, utilities, and staffing [1]. Without the financial burden of expensive retail leases, Wayfair can reinvest those savings into lower prices for customers.

In addition, Wayfair has highly optimized warehouse and fulfillment operations that keep variable costs low. Their proprietary warehouse management system and inventory pooling across facilities helps maximize efficiency and lower fulfillment expenses per order [2]. They’ve also heavily invested in automation technology in their warehouses to reduce reliance on labor. This lean cost structure enables Wayfair to turn profits on transactions with razor-thin margins.

By eliminating physical retail overhead and optimizing their e-commerce operations, Wayfair maintains an agile cost structure that allows them to undercut most competitors on price while still being profitable.

[1] https://pennycanny.com/blog/why-is-wayfair-so-cheap

[2] https://s24.q4cdn.com/589059658/files/doc_financials/2023/q1/CORRECTED-TRANSCRIPT_-Wayfair-Inc-W-US-Q1-2023-Earnings-Call-4-May-2023-8_00-AM-ET.pdf

Data-Driven Pricing Strategies

One of the key factors in Wayfair’s low pricing is their use of sophisticated algorithms and data to dynamically set and adjust prices. Wayfair has developed automated pricing software that analyzes data points like inventory levels, competitor pricing, search volume, and sales history to optimize prices for profitability and competitiveness [1]. This algorithm runs constantly, changing prices on a frequent basis – sometimes multiple times per day – in response to shifts in market conditions [2].

By leveraging big data and AI, Wayfair can tweak prices to find the optimal price point that maximizes sales volume and revenue. This level of pricing efficiency allows them to undercut many competitors while still earning strong margins. The dynamic pricing also creates a constant sense of deals and discounts for customers, as prices fluctuate up and down. While an item may be cheap one day, it could increase in price shortly after, further incentivizing shoppers to act quickly on low prices.

Overall, Wayfair’s data-based pricing algorithms allow it to nimbly respond to market changes and offer customers competitively low prices across its catalog.

High Sales Volume and Economies of Scale

As one of the largest online furniture and home goods retailers, Wayfair benefits from economies of scale due to its high sales volumes. In 2020, Wayfair reported over $14 billion in net revenue, up 55% from the previous year (Source). This massive revenue allows Wayfair to leverage its size to negotiate bulk purchase discounts from suppliers. By purchasing inventory in huge quantities, Wayfair can secure better rates and pass those savings down to customers in the form of lower prices.

Additionally, as a massive e-commerce company, Wayfair can spread fixed costs like IT infrastructure and logistics over a very large sales volume. Their scale enables efficiency and allows them to keep operational costs low. Wayfair can then maintain healthy profit margins while still offering customers rock-bottom prices. The company’s sheer size and sales velocity generate major economies of scale that directly translate to bargain prices for shoppers.

Limited Brand Awareness

One reason Wayfair is able to offer lower prices is that they have lower brand recognition and awareness compared to some established furniture retailers. According to surveys, Wayfair had 78% brand awareness among online furniture shoppers in 2022, which was lower than top brands like IKEA and Ashley Furniture (Source). Since its rebranding in 2011, Wayfair has focused on using low prices and promotions to attract new customers and build market share, rather than investing heavily in brand marketing. As of 2014, aided brand awareness for Wayfair was around 50% (Source). This strategy of lead generation through competitive pricing has enabled Wayfair’s rapid growth, despite having lower brand recognition than longer-established rivals.

With less focus on brand building, Wayfair is able to spend more on maintaining lean operations and passing cost savings to customers. Their strategy aims to make up for weaker brand awareness by providing access to a vast selection of discounted home goods. As customers have positive shopping experiences with Wayfair, brand familiarity and loyalty develops over time. Overall, Wayfair’s pricing model takes advantage of their lower brand familiarity today to rapidly expand their customer base for long-term growth.

Ongoing Promotions and Discounts

Wayfair frequently runs promotions and discounts to drive customer demand and sales volume. As an online retailer, promotional pricing is a key strategy Wayfair uses to stay competitive and attract customers.

Some examples of recent Wayfair promotions include:

- Storewide sales like Black Friday and Cyber Monday with up to 80% off select items

- Category-specific sales like 15% off lighting or 20% off outdoor furniture

- First order discounts such as 10% off your first purchase for new customers

- Limited-time daily deals on select products

These temporary price reductions help entice customers to make purchases. The urgency created by sales ending soon or deals of the day encourages consumers to buy now rather than wait. Offering frequent discounts also helps Wayfair appeal to bargain and deal-seeking shoppers.

According to RetailMeNot, Wayfair has offered over 300 promotional discounts in the past year. With new deals popping up all the time, customers are motivated to check back frequently so as not to miss out on the latest promotions.

Highly Efficient Shipping and Logistics

Wayfair has invested heavily in building proprietary logistics operations to optimize delivery and reduce costs. In 2019, Wayfair opened its first US logistics center, CastleGate, a 1.2 million square foot facility in Kentucky (WayFair XpressServices). Wayfair has also partnered with 3PL providers like Speed Commerce to handle warehouse management, order processing, and shipping logistics (Speed Commerce). These investments allow Wayfair to bypass traditional retail distribution channels and ship directly from suppliers to consumers.

Wayfair uses data and technology to plan optimal delivery routes and improve efficiency. Their logistics network is designed for fast, low-cost shipping, with over 50% of Wayfair’s orders shipped for free. These proprietary shipping operations give Wayfair greater control over the customer experience while reducing expenses associated with shipping and fulfillment. The savings from their efficient logistics network allows Wayfair to maintain lean costs and offer lower prices than many brick-and-mortar retailers.

Lean Cost Structure and Low Margins

Wayfair utilizes a very lean cost structure and operates on razor-thin profit margins in order to offer lower prices. The company has built out a highly efficient supply chain and logistics network that keeps overhead and operating costs to a minimum. Wayfair’s net profit margin as of Q3 2023 was only -5.54% [1]. This willingness to sacrifice margins allows Wayfair to undercut competitors on pricing.

In Q3 2023, Wayfair reported an operating margin of -8.8% [2]. The company is focused on gaining market share rather than maximizing profitability. Wayfair’s ultra-lean operations and low overhead enables the company to operate on thinner margins than traditional retailers. This efficient cost structure is a strategic advantage that allows Wayfair to offer lower prices across its catalog.

By keeping costs low across its operations, Wayfair is able to pass on savings to consumers without hurting its bottom line. The company’s willingness to sacrifice margins for growth has been a key factor in its ability to provide discounted pricing on a wide assortment of products.

Conclusion

Wayfair is able to offer such low prices for several key reasons. Their extensive inventory and optimized supply chain allows them to source products at very low cost. With minimal overhead like brick-and-mortar stores, and data-driven pricing strategies, they can pass the savings directly to customers. High sales volume and economies of scale further reduce costs. While Wayfair lacks the brand recognition of some competitors, their ongoing promotions and discounts continue to attract new customers. An efficient shipping and logistics operation also reduces expenses.

This combination of a lean cost structure and razor thin margins has fueled Wayfair’s rapid growth. Despite lower brand awareness compared to legacy retailers, their pricing advantage allows them to rapidly acquire new customers. With more households shopping online during the pandemic, Wayfair has capitalized on this opportunity.

Their current prices are particularly low due to an inventory glut. After overestimating demand during the pandemic online shopping boom, they are now discounting that excess inventory to drive higher sales volumes. For bargain-seeking shoppers, now is an ideal time to take advantage of these discounts before inventory levels normalize.